A pitch deck is a short presentation that helps you explain your business idea to investors. It highlights your product, the problem you’re solving, your target market, and why your team is the right one to make it happen. In this blog, we’ll show you how to make a pitch deck and walk you through the 10 key slides every great pitch deck should include to make a strong impression.

What is a Pitch Deck?

A pitch deck is a slideshow presentation that succinctly conveys your business idea, market opportunity, and value proposition. Startup founders and entrepreneurs commonly use them to present their business ideas, products, or services, also known as a business or investor deck. It is necessary in securing funding, attracting partnerships, and closing deals.

With a concise format of 10 to 20 slides, this visual tool effectively conveys a business idea and its potential to help entrepreneurs connect with investors, clients, or partners. Suppose your pitch catches the interest of potential investors. In that case, there will likely be an in-depth next meeting (i.e., the start of the actual pitching process).

💡 The most common formats for pitch decks are PowerPoint slides, Google Slides, or Apple Keynote presentations.

Purpose of a Pitch Deck

The purpose of a pitch deck is to clearly and quickly communicate your business’s potential. Used in fundraising pitches, idea support, and forming strategic partnerships, it provides a visual snapshot of your business idea and its market viability.

Pitch decks are not only used by startups but also in a variety of other settings. The structure of your slides should enable potential investors to grasp your business idea’s potential quickly.

Types of Pitch Decks

Not all pitch decks serve the same purpose. Depending on your audience and goals, you might need a different style of presentation. Here are the most common types:

- Startup

- Investor

- Business

- Product

- Branding or marketing plan

- Sales

- Fundraising

- Film & TV

Also Read: Pitch Deck vs Business Plan: Differences and Which to Use

Create Presentations Easily in Google Slides and PowerPoint

15M+Installs

How to Make a Pitch Deck in Google Slides?

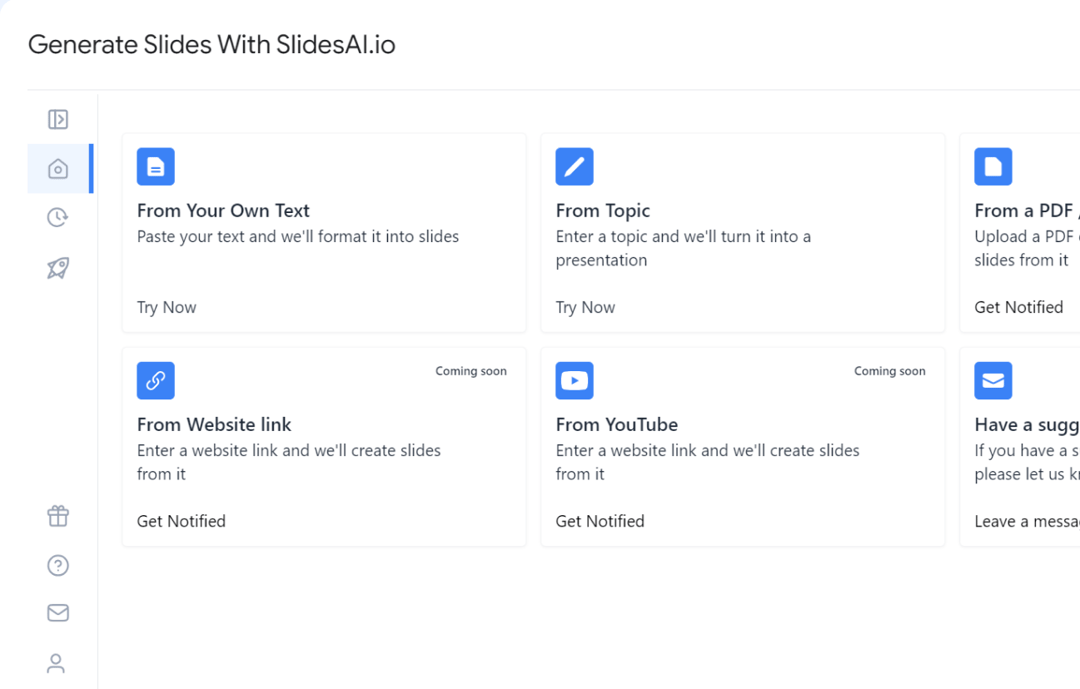

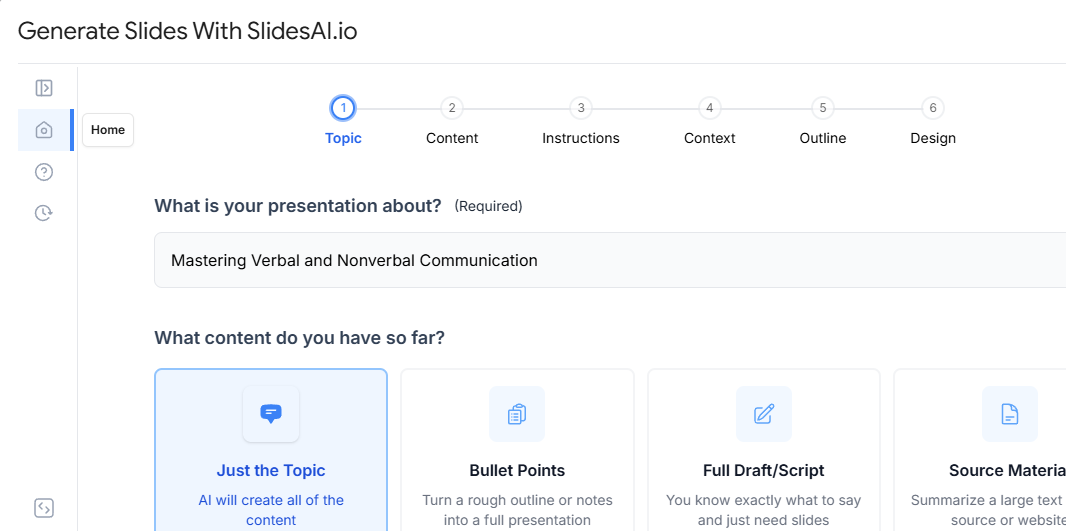

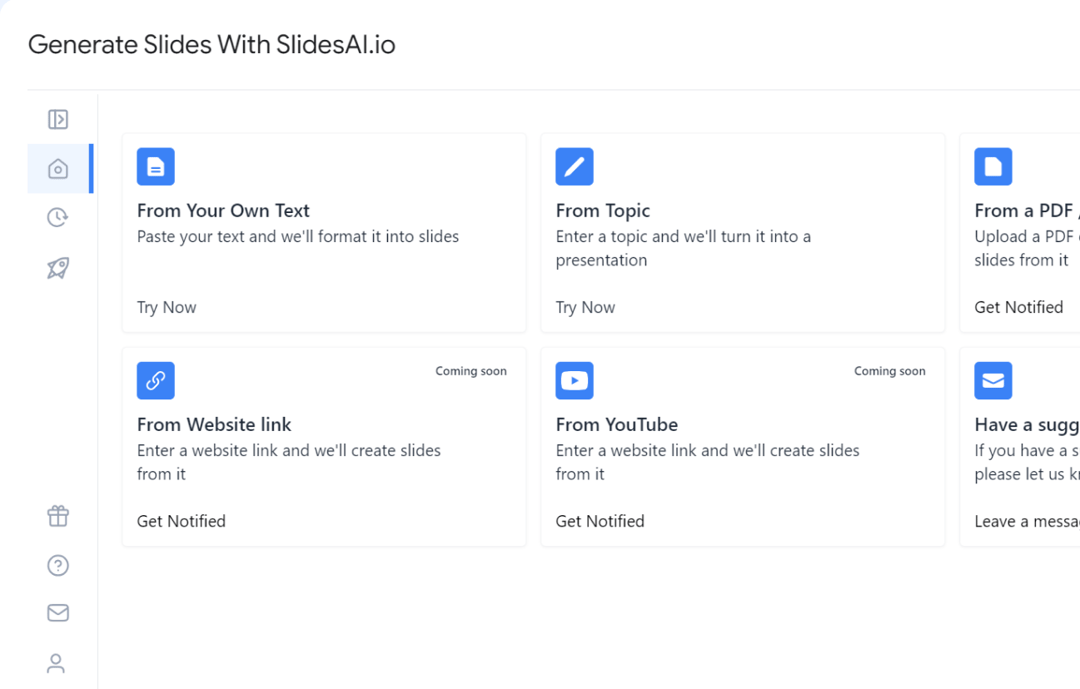

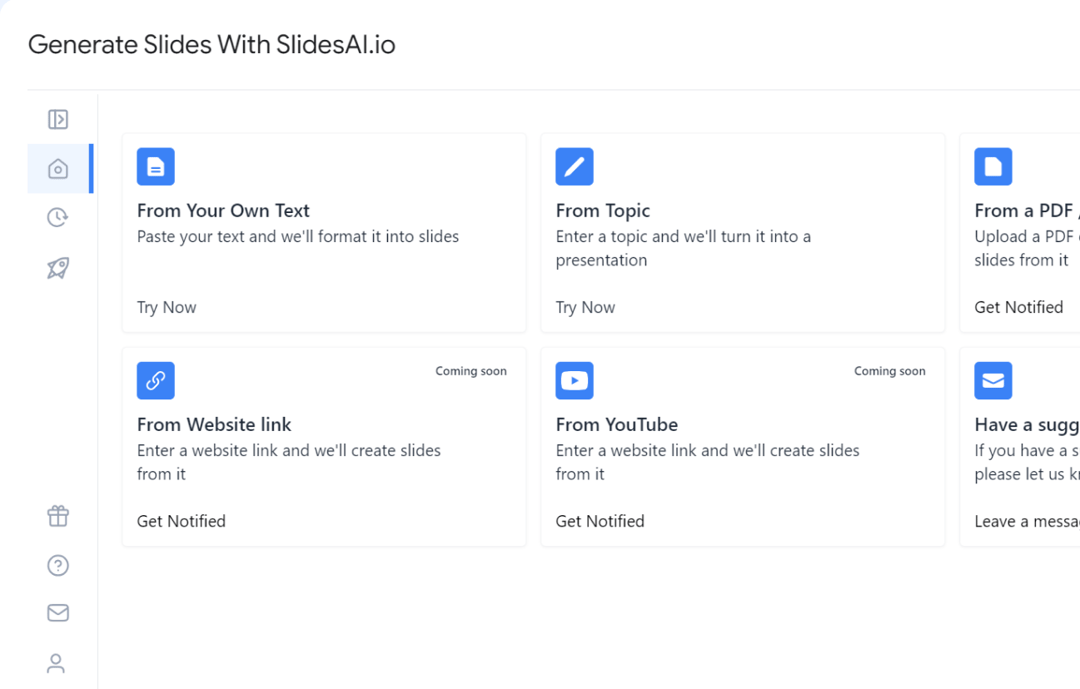

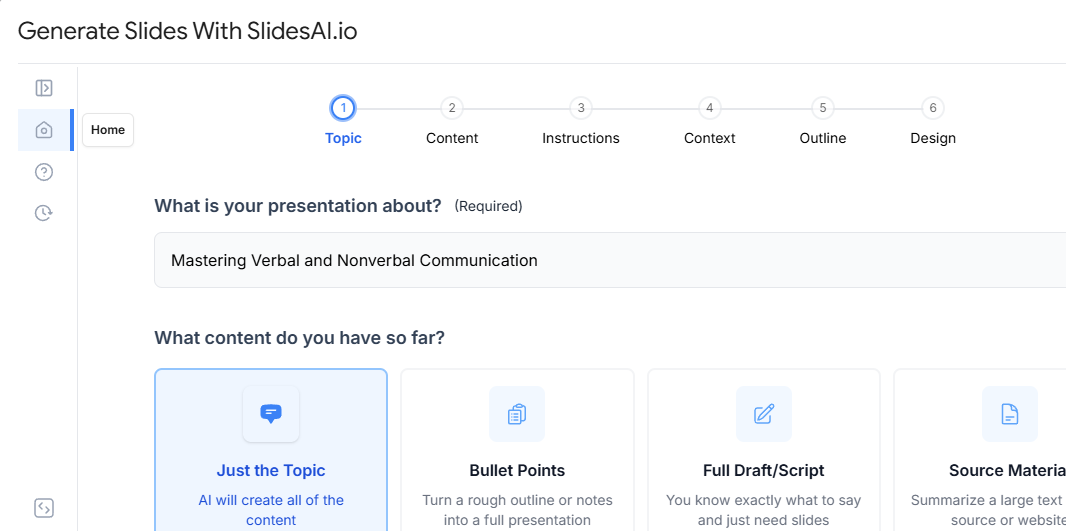

Creating a pitch deck in Google Slides is easier than you might think, especially with tools like SlidesAI to speed things up. Here’s a simple step-by-step guide to help you get started and build a professional-looking deck in minutes.

Step 1: Open Google Slides

Head to your Google Drive, click on the “New” button, and select Google Slides to open a fresh presentation.

Step 2: Install SlidesAI

If you’re new to SlidesAI, go to the SlidesAI homepage and click “Install SlidesAI”. It will integrate directly into your Google Slides for easy access.

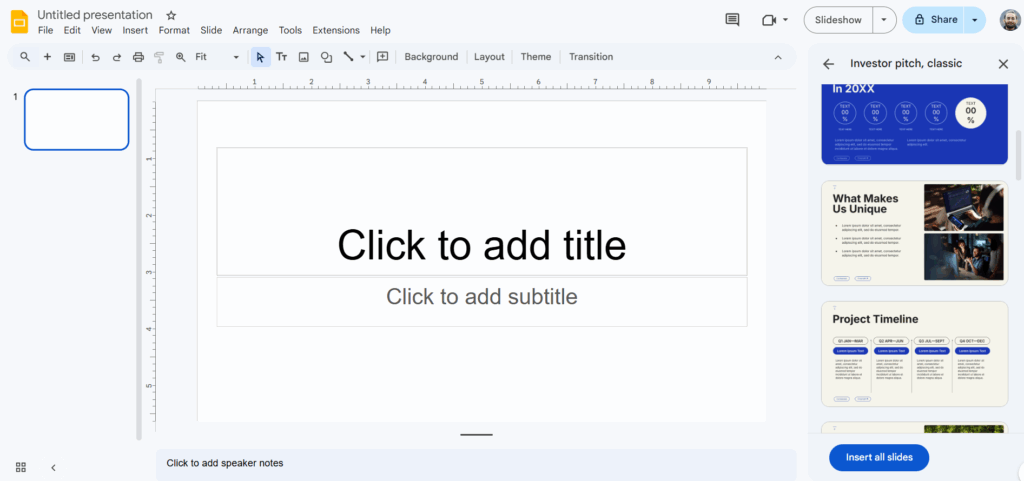

Step 3: Pick a SlidesAI Template

Open your presentation and look for the SlidesAI panel on the right. Browse through the available templates and find one that matches your pitch, like the Pitch Deck template.

Step 4: Add the Slides to Your Deck

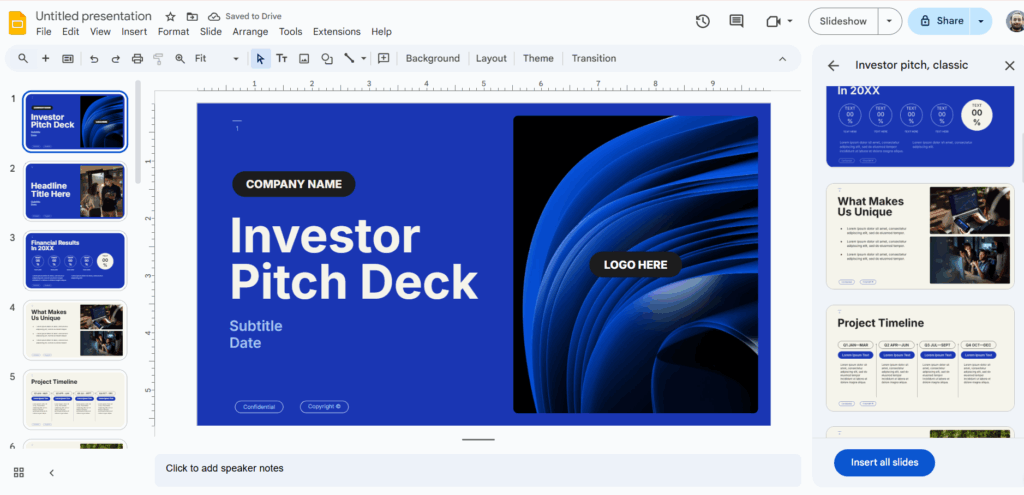

Click “Insert All Slides” to automatically add the template slides to your presentation.

Step 5: Customize Your Content

Replace the placeholder text with your own messaging. Add relevant images, graphs, or data to back up your points and make your slides visually appealing.

Step 6: Apply Your Branding

Update the fonts, colors, and design elements to reflect your brand’s identity. Consistency in visuals helps make a lasting impression.

Step 7: Review and Polish

Go through the deck slide by slide. Fix any typos or layout issues and make sure everything flows smoothly and professionally.

Step 8: Share for Feedback

Once you’re happy with the final version, send it to your team for review or approval before presenting it to investors or stakeholders.

Build Stunning Slides in Seconds with AI

- No design skills required

- 3 presentations/month free

- Don't need to learn a new software

How to Create a Pitch Deck in PowerPoint?

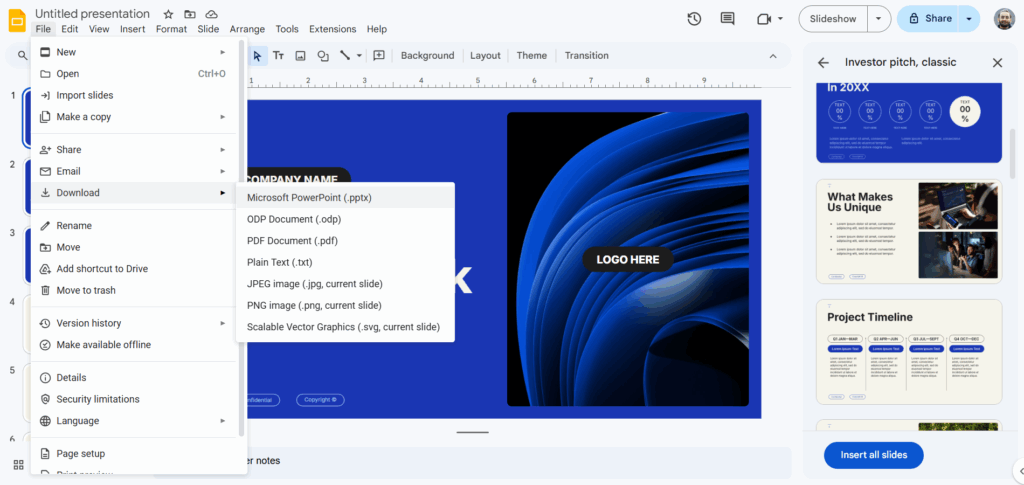

If you want to use your pitch deck in PowerPoint instead of Google Slides, it’s super easy to do. Just follow the steps below:

- Once you’ve created your pitch deck using Google Slides and SlidesAI templates (as explained above), simply head to File > Download > Microsoft PowerPoint (.pptx).

- Your deck will be downloaded as a PowerPoint file. Open it on your computer, and you’re good to go! From there.

- You can tweak the content, adjust formatting, or make any edits directly in PowerPoint. It’s a smooth switch, no extra tools needed.

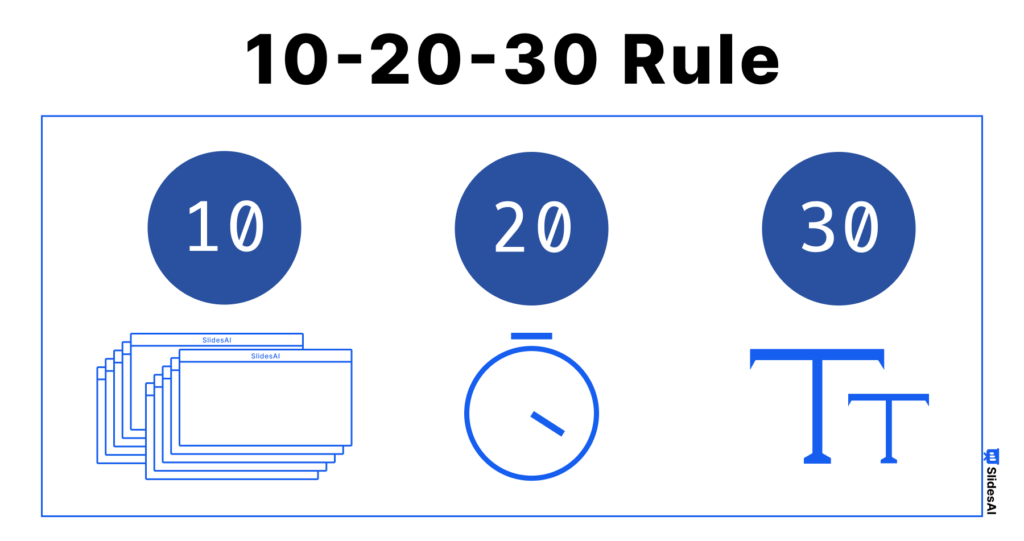

The 10-20-30 Rule for Slideshows

The 10-20-30 rule, coined by venture capitalist Guy Kawasaki, offers a structured approach to creating effective PowerPoint pitch decks. This rule is a favorite among startups but applies to all types of presentations. It includes:

- Keeping to just 10 slides.

- Limiting the presentation to 20 minutes.

- Ensuring a font size of at least 30 points.

However, sticking to 10 slides isn’t always the optimal approach for everyone. As David from NextView VC reminds us, it’s crucial to present in a manner that feels authentic to you. Treat pitch deck templates as flexible starting points, and tailor them to highlight the uniqueness of your startup.

Create Presentations Easily in Google Slides and PowerPoint

- No design skills required

- 3 presentations/month free

- Don't need to learn a new software

What should be in a Pitch Deck?

A pitch deck should concisely outline your business idea, market, strategy, finances, team, and funding needs in an engaging story. You should use between 10 and 20 slides depending on your needs and audience.

The 10 most important slides in an investor deck:

- Business overview: A brief introduction to the business, including the mission and vision.

- Problem statement: Identify the problem or need in the market the business intends to solve.

- Solution slide: The product or service offered by the business as a solution to the identified problem.

- Market size and analysis: Information about the target market and industry, including size, growth potential, and customer demographics.

- Product and business model: How the business plans to make money, including the product and pricing strategy.

- Go-to-market plan: The approach to promoting the product or service and acquiring customers.

- Competitors: A look at the competitive landscape and how the business differentiates itself from competitors.

- Financials: Financial projections and current financial status.

- Team: Information about the key team members, their roles, and their experience.

- Ask: The specific funding request and how it will be used to grow the business.

In the next section, we’ll guide you through creating each slide.

How to Create a Pitch Deck Manually?

We’ll take a step-by-step approach to making the essential 10 slides in a pitch deck. It will cover the most critical aspects of your business idea and pitch presentation. You may add more slides as you go, but let’s start by looking at each of these 10 slides, their purpose, and what information should be included.

Slide 1: Business overview

The first slide of your pitch deck will set the tone for the rest of the presentation. The business overview (title slide) should briefly capture the core of your idea and stand out to investors.

- Include your logo.

- title slide

- Name of your idea, business, or startup.

- Summarize your concept into a catchy headline.

Slide 2: Problem

Use this slide to lay the groundwork of your pitch by focusing on the problems or pressing needs that your business addresses. Highlight the market gap and illustrate why it’s an important opportunity.

- Present the problem your business solves in the form of a problem statement.

- Emphasize its relevance to your audience.

- Back up your points with solid data like market statistics or instances of current inefficiencies.

Slide 3: Solution

The solution (or value proposition) slide should address each problem mentioned in the previous slide. There could be many ways to solve a problem, so clarify how your solution benefits your target segment.

- The value proposition of your product or service.

- What sets it apart from competitors.

Slide 4: Market size

This slide should provide a clear picture of the market analysis and landscape based on your research. Illustrate the scale of the market you’re targeting or part of, demonstrating growth prospects and business opportunities. Key points to include:

- Break down the market opportunity into TAM, SAM, and SOM.

- Note any important market trends.

- Use visual aids like charts or graphs to effectively depict market size and trends.

Slide 5: Product & business model

Summarize your product and business model in this slide to show how you will make money, scale, and be profitable.

- Highlight your product’s main features or services.

- Add visuals like screenshots or images for clarity.

- Detail your revenue streams, cost structure, and pricing strategy.

Be ready to explain any challenges within your business model and your solutions.

Slide 6: Go-to-market strategy

The go-to-market (GTM) slide outlines your strategy for entering the market and acquiring new customers. Explain how you will distribute your product or service and reach your target audience.

- Outline each phase of your GTM strategy.

- Define your ideal customer or buyer persona and how you provide value to them.

- Explain your sales and marketing approaches to reach customers.

Having a good idea or product isn’t enough to convince investors. They need to know if you have a viable, thought-out strategy to reach and serve the target market.

Slide 7: Competitive analysis

Demonstrate your understanding of the market and the competition in this slide by providing data and market research. The best part is you don’t have to do this research manually. You can leverage Python web scraping to help you gather and analyze large datasets from various online sources, which will save you lots of time and effort. Offer data-driven research to map out the competitive landscape, including:

- Identification of major competitors and alternatives.

- Specify your unique selling proposition (USP) and competitive advantage.

- Strategy and positioning against competitors.

Be straightforward in this slide and reassure investors that you are aware of your competition and have a plan to achieve and maintain a competitive edge. You could mention potential challenges, risks, or disruptors.

Slide 8: Team

Many investors often consider the team behind a startup as one of the most critical factors in their decision-making process. A study done on over 21,000 startup founders suggests that the founder’s personality – or the combined personalities of the founding team – is paramount to entrepreneurial success.

- Include all founders, management, and advisors.

- Roles and responsibilities.

- Highlight key skills and relevant experience.

- Mention any meaningful connections.

The team slide has to instill confidence in potential investors that this is the right team for the job, even if you are a solo founder.

Slide 9: Financials

This is a critical slide where investors may spend the most time reading to get a glimpse into the business idea’s financial feasibility and potential return. Describe how you plan to generate revenue and your pricing strategy. Each startup will show different financial figures based on their stage.

Basic financial data:

- Revenue

- Income statement

- Sales forecast

- Expenses and burn rate

- Profitability

- Market size (Total Addressable Market, Serviceable Available Market, Serviceable Obtainable Market)

- Projected revenue growth for at least three years.

Other KPIs you may include:

- Customer acquisition cost (CAC)

- LTV/CAC ratio (indicates how sustainable the business model is)

- Churn rate

- Customer growth

Coming up with these figures demonstrates your financial acumen and your understanding of the key metrics that drive business success.

Slide 10: Ask

The last slide should wrap up the pitch with a snapshot of your current standing, any accomplishments, a timeline, and the use of funds.

- The current state of affairs (growth, market share).

- State the amount of funding needed and how you plan to use it.

Investors want to know if your startup/idea is worth investing in, so show them evidence of progress, past successes, or the potential for future success.

Also Read: How to Create Impactful Presentation for Investors?

What Makes a Good Pitch Deck?

A good pitch deck gets your point across to investors and captures their attention. Successful pitch decks are clear, focused, and persuasive. Many investor pitch decks follow a similar structure because they give investors a snapshot of a business’s investment potential.

These are traits of a good pitch deck:

✅ Concise and clear, without fluff or distracting details.

✅ Focused on telling the story of the startup/idea and its potential.

✅ Structured with a logical flow. Each slide supports the overall narrative.

✅ Persuasive, backed by data, research, and appropriate graphs and charts.

💡 Save time by using an AI pitch deck presentation maker like SlidesAI

Create Presentations Easily in Google Slides and PowerPoint

15M+Installs

Best Pitch Deck Examples

A great pitch deck tells a compelling story and grabs investor attention within minutes. If you’re looking to craft a winning deck, learning from the best is a smart place to start. Below are some of the most notable pitch deck examples from successful startups, plus one tool you can use to create your own impressive version effortlessly.

1. SlidesAI Pitch Deck

SlidesAI helps you generate professional, visually engaging pitch decks directly within Google Slides. With a wide range of templates—including dedicated pitch deck formats- it takes the guesswork out of design, layout, and structure. Whether you’re just starting out or refining your final deck, SlidesAI saves you hours of formatting so you can focus on telling your story.

Check out more free pitch deck templates here.

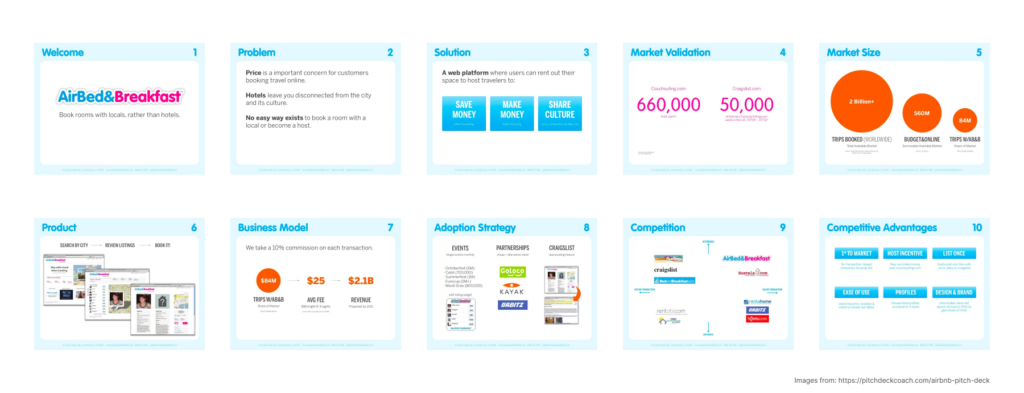

2. Airbnb Pitch Deck (Pre-seed)

In 2008, Airbnb introduced its concept of “AirBed & Breakfast” through a straightforward 10-slide deck. The presentation clearly outlined the problem of expensive hotel accommodations, proposed a solution via a peer-to-peer platform, and highlighted the market potential. This clarity and focus helped Airbnb secure $600K in early funding.

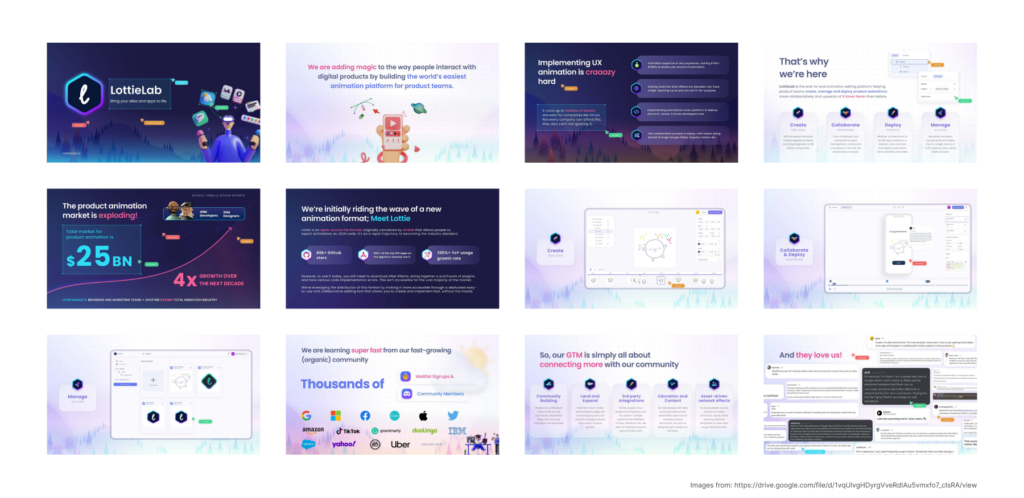

3. LottieLab Pitch Deck (Seed)

LottieLab raised $4 million in seed funding in 2022 to build a collaborative motion design tool using the Lottie format. Their pitch deck stood out by clearly showing their product’s value, team strength, and growing market demand. Investors included Point Nine, 20VC, and founders from Webflow and Slack.

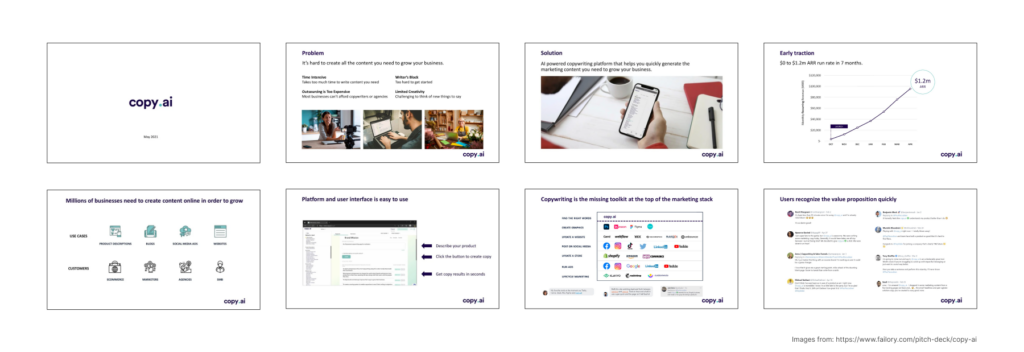

4. Copy.AI Pitch Deck (Series A)

In 2021, Copy.AI secured $11 million in Series A funding to enhance its AI-driven copywriting platform. The pitch deck effectively showcased the company’s rapid growth, from zero to $2.4 million in annual recurring revenue within a year, and its strong market demand. Investors included Sequoia, Craft Ventures, and Tiger Global.

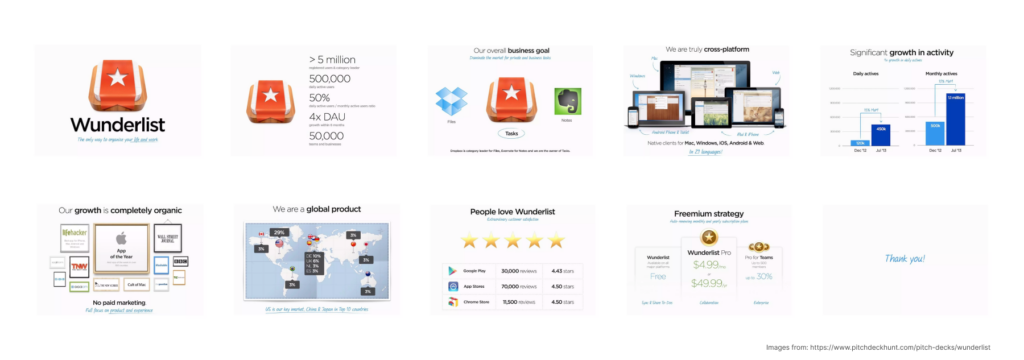

5. Wanderlist Pitch Deck (Series B)

In 2013, Wunderlist, developed by Berlin-based startup 6Wunderkinder, raised $19 million in Series B funding. Their pitch deck effectively showcased the app’s user-friendly design, cross-platform capabilities, and growing user base, attracting investors like Sequoia Capital and Atomico. This funding supported their expansion and product development, leading to Microsoft’s acquisition of Wunderlist in 2015.

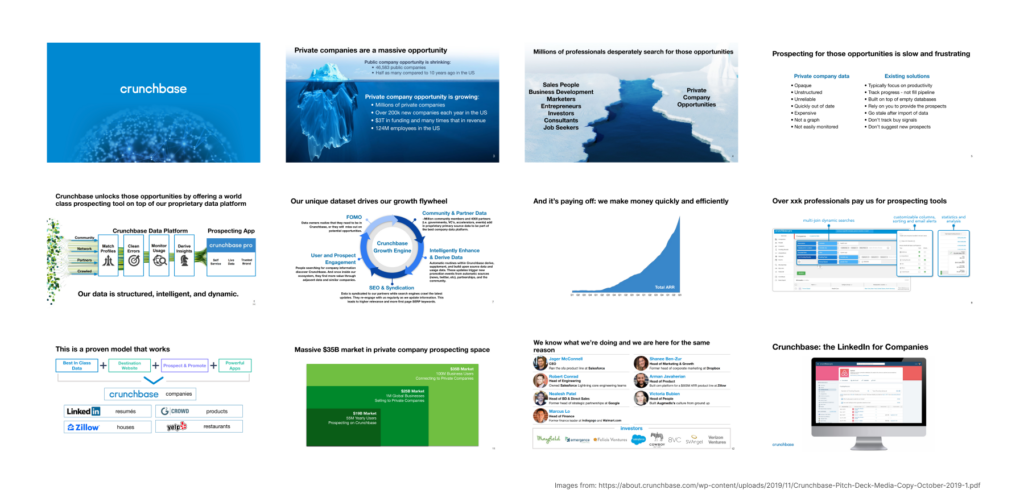

6. Crunchbase Pitch Deck (Late stage)

Crunchbase’s late-stage pitch deck in 2019 contributed to their $30 million funding round. The deck focused on their role as a leading destination for company insights, offering data on startups to Fortune 1000 companies. It highlighted their growth metrics, market opportunity, and strategic vision, appealing to investors interested in data-driven platforms.

Top 3 Mistakes to Avoid With Your Pitch Deck

These common mistakes can diminish the impact of your presentation. Strive for a balance between thorough information and simplicity for maximum impact.

Mistake 1: Overemphasizing aesthetics

Overdesigning your slide deck can detract from your core message while pitching. In most cases, it is safe to leave out PowerPoint animations and excessive graphics. Use brand colors if possible; any image, graph, or chart you include should directly support your narrative.

💡 Pro tip: Maintain a consistent visual theme and leave out flashy design elements.

Mistake 2: Overloading information

It’s natural to want to share a lot of information on each slide, but doing so can make it harder for your audience to tell what’s important. VCs hear hundreds of pitches each year – you need more clarity in your pitch to catch their interest within your allocated time. Focus on the key information and overall structure of the pitch deck presentation.

💡 Pro tip: Prioritize clarity and conciseness to make a lasting impact.

Mistake 3: Lack of personalization

Pitch deck templates are a great starting point, but remember to tailor your pitch and content to your audience. Investors differ in their interests and priorities. Understanding what your audience value can significantly improve your pitch’s impact.

💡 Pro tip: Find out what resonates with your audience and include or address them in your deck.

Build Stunning Slides in Seconds with AI

- No design skills required

- 3 presentations/month free

- Don't need to learn a new software

Conclusion

Creating a compelling pitch deck is an essential step in turning your business idea into reality. By clearly telling your story, highlighting your unique value, and backing it up with solid data, you can capture investor interest and open doors to growth opportunities.

Remember to keep your deck concise, visually appealing, and tailored to your audience’s needs. Leveraging tools like SlidesAI can simplify the process, helping you craft a professional presentation faster and with less hassle. With the right approach and preparation, your pitch deck can be the key to securing the funding and support your startup deserves.

Frequently Asked Questions About Pitch Deck

Is a pitch deck the same as a business plan?

A pitch deck and a business plan are not the same. While a pitch deck visually presents key aspects of your business idea, a business plan is a comprehensive written document that outlines all aspects of your business. A pitch deck can summarize your business plan but cannot replace it.

What happens after a successful first pitch?

Pitch deck guides often focus on the initial meeting with venture capitalists, but that’s just the start. Investment decisions involve multiple meetings, due diligence, negotiations, and paperwork. As NextView VC’s David Beisel puts it, “The purpose of all venture capital meetings is to get another meeting.” Read more about what to expect after a successful first pitch.

What about other slides, like the traction slide?

Traction slides are to showcase proof of any progress, achievements, and market acceptance. For early-stage startups, including pre-seed, traction might not necessarily mean revenue. It can be any evidence that validates your business idea and market demand, such as user sign-ups.

Can I use a template to create a pitch deck?

Yes, using a professional template is a smart way to create your pitch deck. It helps you organize key information clearly and keeps the design consistent, making your presentation more polished and easier to follow.

What should you not include in a pitch deck?

Avoid including jargon, overly detailed financial data, or vague statements that don’t add value. Your pitch deck should be straightforward and focused on the most important points to keep investors engaged and informed.